Mission Statement

"To provide the taxpayers adequate information on paying their taxes .”

The county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes.

The collector is responsible for collecting all property taxes from the first day of March to the 15th day of October during the calendar year after they are assessed.

By statute, the collector is required to turn over all tax revenue to the treasurer at least once a month. Taxpayers may pay their taxes in installments.

Installment Payments are due by the 3rd Monday in April, 3rd Monday in July and balance by October 15th.

Mandatory Utility company installments are due by the 3rd Monday in April, 2nd Monday in June and balance by October 15th.

Late Payment penalty of 10% of amount due by installment date will be applied for any late installment payment per (ACH 26-35-501).

Mortgage Companies who are escrowing funds for the property owners are required to remit payment within 60 days of March 1st. (ACA 26-35-101).

Any real or personal property taxes not paid by the 15th day of October are considered delinquent and the collector extends a 10% penalty against the taxpayer (ACA 26-36-201).

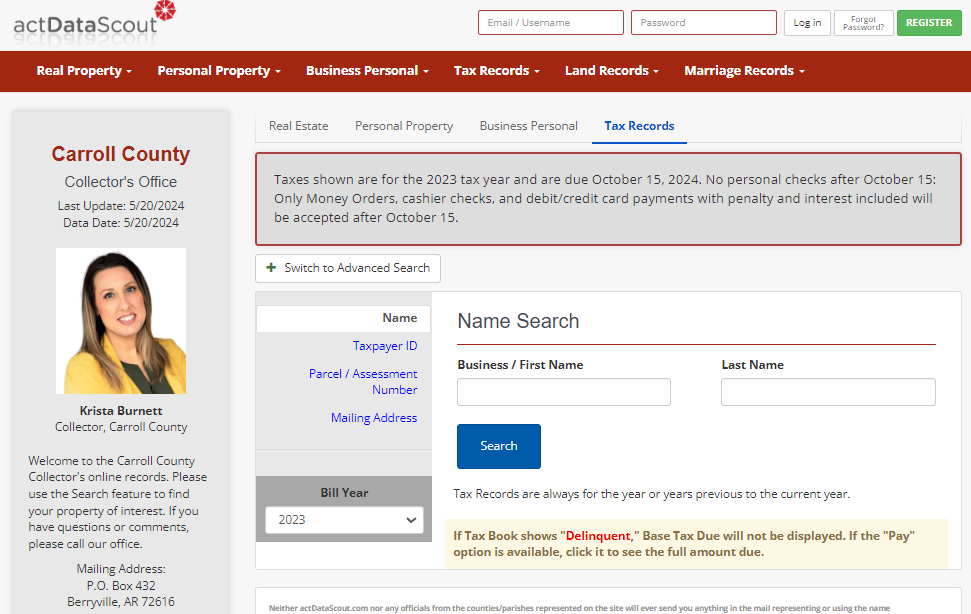

Tax Record Search

Carroll County's tax records are available online and free to the public. Search records by assessment number, name or mailing address.

Pay Taxes Online

For Directions on how to pay your taxes online or by phone.

Assessor Record Search

Search Real, Personal, or Commercial Personal Property.