Mission Statement

“To provide fair and equitable real property assessments in junction with all state laws. To serve the public in a professional manner and assist them with their property assessment.”

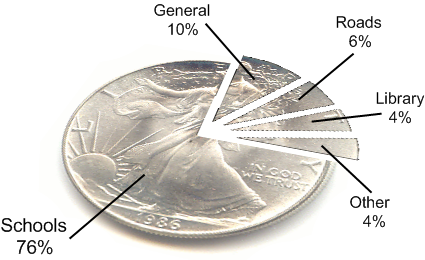

Arkansas county assessors’ offices are responsible for discovering, valuing and listing property for tax purposes. Each of these responsibilities are challenging. Discovering newly constructed buildings, while not too much of a challenge in cities with building permits, can be very difficult and expensive in rural areas. Valuing property is a profession that is regulated by state and federal law, and though property assessment appraisers are exempted from these regulations, they are expected to live up to the same standards as other appraisers. Listing property is building a record about a property - its physical makeup, its ownership, its taxable status, and all the changes that may occur to any of these. County assessors’ budgets are funded by all taxing units in a county. Each taxing unit contributes a share equal to its percentage of total property taxes collected in a county.

The duty of the county assessor is to appraise and assess all real property between the first Monday of January and the first of July, and all personal property between the first Monday in January and the thirty-first of May.

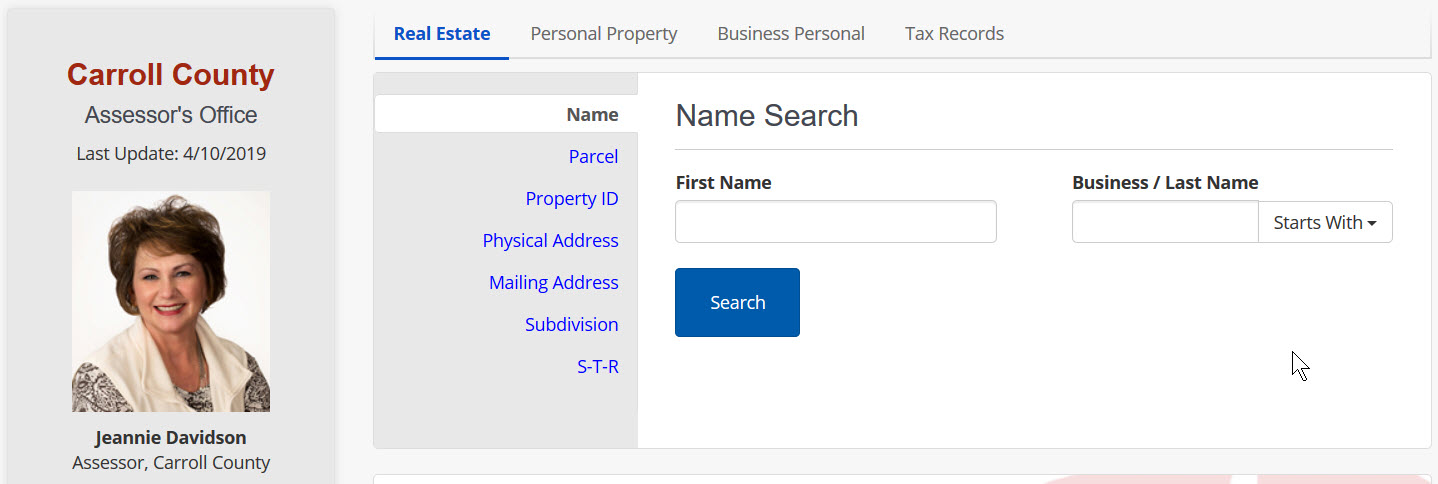

Real Property Search

Carroll County's real estate records are available online and free to the public. Search records using a variety of different search criteria such as name or address.

Professional Searching

Professional searching is available for those individuals who need more options, more control, and more powerful features to fine-tune property searches than what is provided by the public search.

Links

-

Ark State Land Surveyor

State Land Surveyor's website. Search for plats across the state. -

I.A.A.O.

International Association of Assessing Officers -

Ozark Regional Transit Authority

Ozark Regional Transit provides transportation for residents of Carroll County. -

Business Property Assessment

The annual deadline is May 31.